Affordable funeral cover that truly covers funeral costs

If you're shopping around for the most affordable funeral cover or funeral plan in South Africa, you're going to want to read this blog post.

Why Meerkat Funeral Cover is the best value for your money in South Africa

With Meerkat, you get affordable funeral cover that truly covers you.

A list of our funeral cover benefits:

- We offer competitive funeral premiums that can actually cover the cost of what funerals cost in South Africa.

Did you know: a basic cremation or grave burial service could cost you between R18 500 to R22 000 at Avbob.- When comparing funeral cover it is very important to check not only the monthly premium amount, but the total lump sum you would be paid out for that premium amount too.

- A 30-year-old female earning R33 000 per month can get covered for only R45 per month at Meerkat. The cover amount she could get would be R45 000. This is enough money to ensure dignity in death.

- In comparison, a popular insurer offers the same amount of cover for R64 per month. For the same monthly premium amount, that same individual would only be covered for a total of R10 000. If this family decided to make use of Avbob’s services, they would still have to fork out extra cash even after the payout of the lump sum.

Read: Can you afford to die? The cost of funerals in South Africa

- We’ve already paid out millions of Rands in claims.

- Our valid claims payout process takes up to only 48-hours.

- We have expert fraudulent management systems in place to weed out any fraudulent claims activity so that you do not have to pay for it.

- We offer certainty of premium

- Very important when choosing your funeral cover is to read the terms and conditions.

- Check to see if your premiums will increase every year. Many companies increase their premiums annually. However, with Meerkat, we do not do this. You can expect to keep the premium that you initially signed up with.

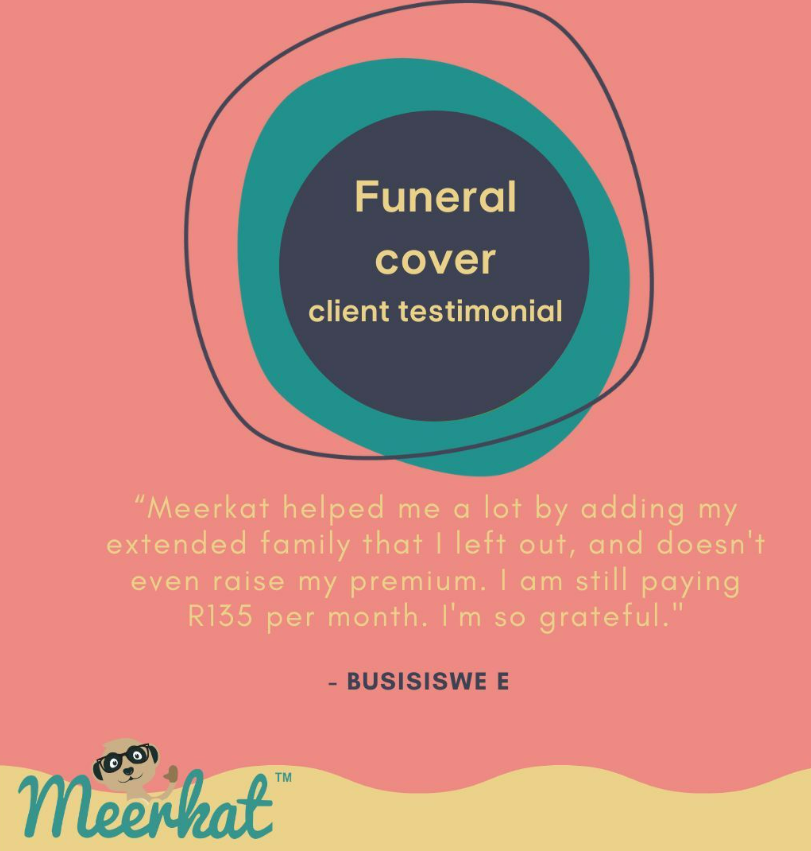

Do you have funeral plans for different family members? You could be paying more than what you need to. Instead, see how Meerkat can offer your one plan for all your family members, including your extended family.

Should you get life insurance or funeral cover?

When considering which type of insurance product is best suited for you, you should first consider what your needs are for this insurance.

- Is it to cover immediate costs of a funeral?

- Do you need a long-term or short-term benefit for this cover? Is there more than funeral costs that you want to be taken care of?

- What does your budget allow you to allocate for this insurance?

Life cover

Unlike funeral cover, life cover is intended to finance not just the short-term needs of a funeral, but the long-term or ongoing needs of life too. Life cover helps ensure that your debts, or the financial obligations that you had, are covered even when you die.

With life cover you can, for example, have enough money to pay for the educational needs of your children as well as cover your home loan repayments. Because of this, life cover is usually a bigger amount of cover to ensure that all these needs are taken care of.

Life cover protection while you're still alive

Life cover can also protect you and your family if unexpected events, other than death, do arise. These unexpected events can include retrenchment and temporary or permanent disability. If you are without income because of these reasons, credit life cover can help you remain on top of your debts.

Does life insurance include funeral cover?

Life insurance can include funeral cover too. The type of life insurance is dependent on your insurer and the life insurance package they offer you.

MyMeerkat FSP (Pty) Ltd is an authorised financial services provider (FSP 50979). Underwritten by OMART. The Old Mutual Group has been paying claims for over 170 years so you can rest assured that you are in safe hands.