Funeral Cover Comparison - Find the right cover for you & your family

Why do I need funeral cover?

Funeral cover is a type of insurance that, in the event of your death, pays a predetermined amount to your family in order to cover the costs of your funeral.

When doing the initial research into attaining funeral cover, you'll find that there are numerous factors to consider. The number of different cover options available may be overwhelming, that's why we conducted some market research on your behalf.

A funeral package allows families to grieve the loss of a loved one and not worry about any additional burdens, such as the financial stress of planning and paying for a funeral.

Funeral cover generally covers the cost of airtime to make arrangements with family members, flowers, the tent, tables, chairs, groceries for the funeral event, and all other expenses that are related to the funeral itself.

We analysed the various funeral cover packages offered by different financial service providers and compared them to the Meerkat funeral cover, underwritten by Old Mutual Alternative Risk Transfer Limited (OMART).

In order to assist you in finding the right funeral cover that suits your budget and needs.

We analysed the various funeral cover packages available to a 37-year-old parent who earns between R6 000 and R30 000 per month and is searching for funeral cover of R20 000.

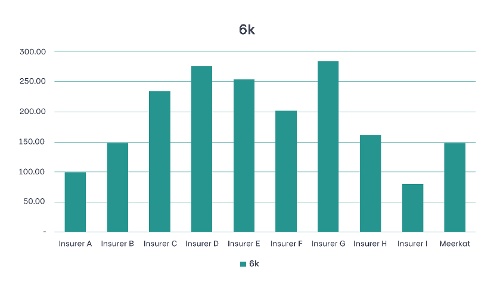

Comparison A: Household income of R6000 with R20 000 cover.

The graph below depicts the monthly funeral premiums from various insurers.

When keeping all the variables constant i.e.:

Mum, Dad (37 years) with kids, earning a household/policyholder income of R6000 per month, that's looking for R20 000 funeral cover. Most traditional insurers are not competitive compared to Meerkat. Our premiums are higher than only 2 Insurers, A and I as shown above.

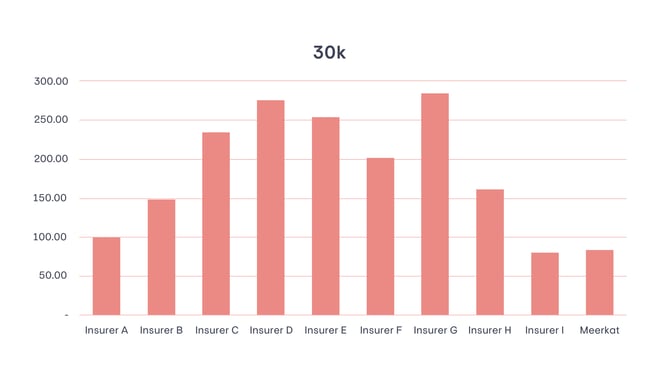

Comparison B: Household income of R6000 - R30 000

The graph below depicts what will happen to the cost of funeral insurance on a monthly basis if the policyholder's monthly income rises to R30 000.

In comparison to Meerkat's burial premium, traditional insurers become much more expensive as the household or policyholder's income rises. Meerkat's premium decreases steadily as the income level rises between R6 000 and R30,000.

As income increases, Meerkat becomes the cheaper option.

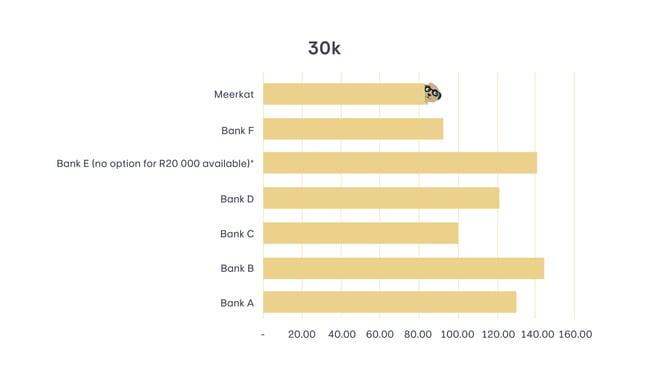

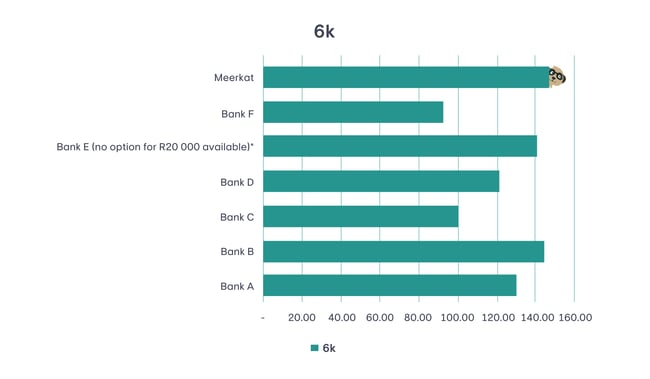

A Comparison Of The Various Funeral Insurance Premiums Offered By Different Banks

When it comes to banks, we compete in the high-income categories. Other banks offering burial insurance are not as competitive as Meerkat, as shown in the R30 000 income graph below.

Anything between the 2 income bands makes Meerkat super competitive, again as the income increases from R6 000, you get a gradual decrease in the premium.

How do you choose the best funeral cover in South Africa? Find out how.

Increased Income vs. Funeral Coverage Premiums Payable

To summarise, for an R200 premium with Meerkat, clients will be able to get more coverage as their income grows. This R200 will get a customer R50 000 cover on an R30 000 income. However, with a salary of R 6 000, R 200 is insufficient to provide R30 000 in coverage.

The Family construct used in the Analysis is:

Mum:37

Dad: 37

2 Kids.

Do you want to learn more about how the Meerkat Funeral Cover can benefit you? Click on the button below and enquire.