What you need to know about credit reports in South Africa

What is a credit report?

A credit report is a detailed overview of your credit history compiled by a credit bureau. For you, it’s a good way to monitor your financial health to ensure you’re on the right track. It's especially good to check ahead of applying for credit. For a credit lender, it is used to assess your risk profile and credit worthiness.

Read: Here's how you get approved for a personal loan

What is a credit bureau?

A credit bureau is a company that collects data based on your credit history and accounts. In South Africa, there are 4 main credit bureaus:

- Experian

- TransUnion

- XDS (Xpert Decision Systems)

- Compuscan (now owned by Experian)

All credit bureaus should be registered with The National Credit Regulator (NCR). Here is a list of all registered credit bureaus. According to the website, there are a total of 53 credit bureaus registered in South Africa.

How do I check all my debts?

You can use a credit report to check all your accounts or debts. A credit report or credit check should also give you information concerning:

- Your credit score

- A record of your payment of those debts (your payment history)

- Previous loan enquiries/ applications

- Credit limits

- Detailed overview of your accounts or debts (for example, credit cards, store/retail accounts, home loans etc)

- If you have any accounts that have been handed over for collection and any judgements that are against you

Moku insight: Credit reports will reveal slightly different information based on the credit bureau you request the report from. The reason for this is that not all credit lenders report the same information to all consumer reporting agencies (CRAs). CRAs here are companies such as Experian and TransUnion.

Have a judgement on your credit report? Read this blog post to find out how you can have a judgement removed from your credit report.

Credit score explained according to Experian’s scoring system

Individuals with a very low score are seen as a high credit risk for credit lenders or banks. If you have a very low score, this will work against you and your loan application may be rejected.

500 - 594 very high risk

595 - 610 high risk

611 - 628 average risk

629 - 659 low risk

660 - 750 minimum risk

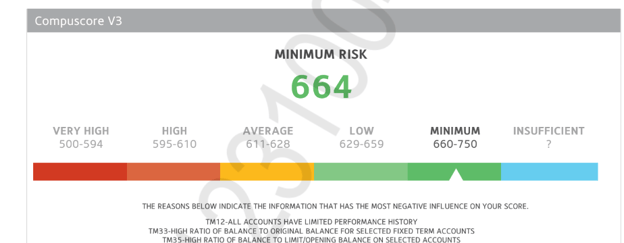

Below is an image of an example of what your credit score could look like in your credit report

What is an acceptable credit score in South Africa?

If we look at the image above and the scoring system Experian uses we can see that an acceptable credit score in South Africa would be between 610 -750.

What’s a good credit score in South Africa?

A good credit score will depend on the credit bureau you are requesting information from. Different lenders and banks usually request credit reports from different and multiple credit bureaus. According to Experian’s credit scoring system, a good credit score would be anything from the average score (611-628) to the minimum (660-750).

It’s definitely in your best interest to regularly check your credit record (credit report). This will help you give you an idea of your risk profile according to banks and credit lenders.

Get your FREE credit score in South Africa.