How to get clearance certificate from debt review?

If you're nearing the end of your debt counselling process, you should soon be receiving your debt clearance certificate. This certificate or process can sometimes be referred to as a:

- credit clearance certificate

- ITC clearance certificate/ ITC clearance for debt review

- Form 19 for debt review

*ITC refers to the credit bureau TransUnion which was previously named ITC. It's important to note, however, a credit bureau removes your debt review flag from your credit report, but they don't issue the clearance certificate.

To receive your clearance certificate for debt you must have paid up all your debt.

Before finding out how you can get your debt review clearance certificate, let's tackle what it actually is.

What is a debt review clearance certificate?

Your debt clearance certificate is a formally recognised document, also known as Form 19 by The National Credit Regulator, that confirms you have successfully completed the debt review (debt counselling) process.

This document must be issued by a registered debt counsellor for it to be valid. ALL of our Debt Counsellors at Meerkat are registered with the National Credit Regulator (NCR).

To be issued with a debt review clearance certificate, you have to meet these requirements:

- All of your debt counselling fees must be paid.

- All of your accounts that have been restructured according to a debt repayment plan, including the repayment terms, must be settled. This includes, but is not limited to: credit card debt, store credit debt, personal loans etc.

- If you have a home loan, there can still be money owning, you just have to be up-to-date with all monthly payments, and be able to pay them should you be issued with a clearance certificate.

Interested in finding out how you can leave your debt review process early? Read this blog post.

How do I get my name cleared from debt review?

If you want your name cleared from debt review, you must be issued with a debt review clearance certificate.

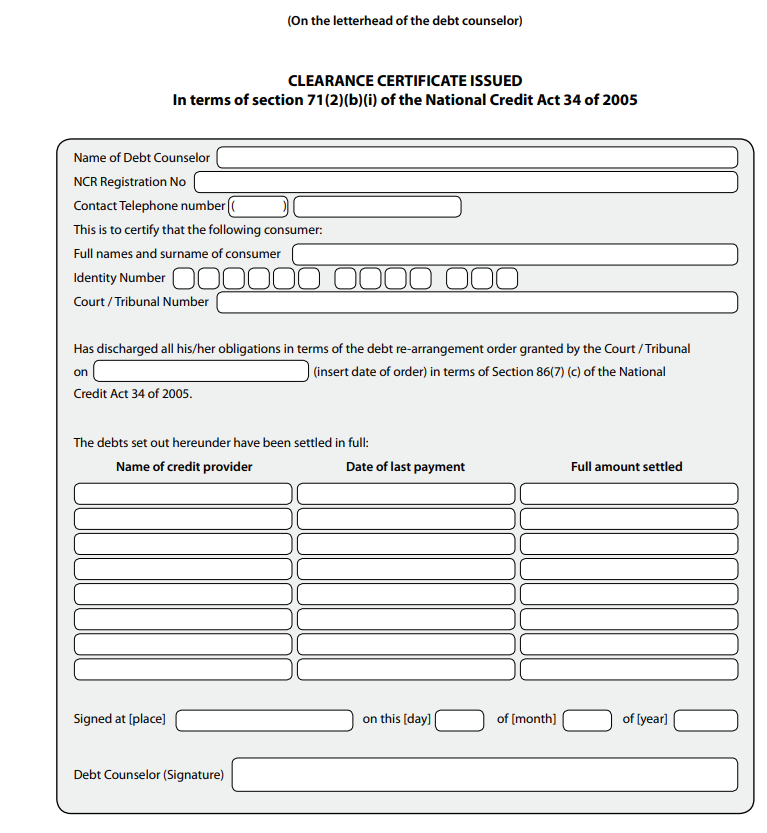

Below is a debt clearance certificate sample:

Do I have to submit my debt review clearance certificate to all my creditors?

No. All your creditors will issue a paid-up letter to your Debt Counsellor. Your Debt Counsellor will then use this to produce a clearance certificate. Under section 21 of The National Credit Amendment Act, Debt Counsellors then submit a certified copy of this clearance certificate to all the Credit Bureaus.

Credit Bureaus will then remove the debt counselling flag from your account to indicate that you've successfully completed the debt counselling process.

The three main Credit Bureaus in South Africa:

How do you get a clearance certificate?

In short, to get issued with a clearance certificate you have to ensure that all your debt is paid up. The only debt that can be outstanding is your home loan. Think you qualify? Start your online application for a clearance certificate now.

How long does it take for the clearance certificate?

At Meerkat, if you have all your paid-up letters from your creditors, we can issue you with a clearance certificate within 10 days.

How much is a clearance certificate?

If you have all your paid-up letters, a clearance certificate will cost you R1150 (including VAT) at Meerkat.

How do you check if you have been cleared from debt review?

You can get a copy of your credit report to see if you are still flagged as being under the debt review process. If you are, there will be a warning on your credit report.

Can I buy a car immediately after debt review?

After receiving your clearance certificate or successfully completing the debt review process, you need to give the Credit Bureaus time to update your profile. It's often best to allow for 3-4 months before applying for credit.

My debt is paid up but I can't get hold of my Debt Counsellor

We have helped many clients who have paid up their debt but are still flagged on the credit bureau as being under debt review, even after they completed the debt review and cannot get cleared. We can help you with your credit record.

This is often because they cannot get hold of their registered Debt Counsellor or their Debt Counsellor is no longer in practice. If you find yourself in this position, complete our simple online application here.

We'd be happy to help with administration of your clearance certificate and advise your creditors and contact the credit bureaus on your behalf.

SHARE OUR ARTICLE: